Share This Story, Choose Your Platform!

As the pandemic eases, construction costs are rising across the commercial sector. There are several uncharted factors impacting these market forces. However, even with the increases, demand is expected to rise as retail, offices, medical facilities, industrial properties, and multifamily businesses re-enter sectors of the economy they have put off during the last eighteen months.

Commercial real estate inventory, demand, cost of building materials, supply chain disruptions, interest rates, labor shortages, and the pandemic are heavy influences of current pricing trends. Federal infrastructure spending in the near future is expected to squeeze resources further. You may continue to see construction costs rise or at the very least remain unstable for the next year or two.

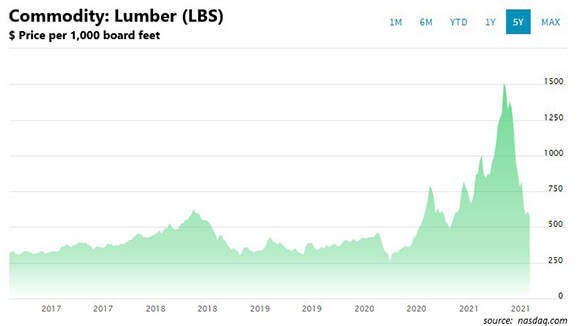

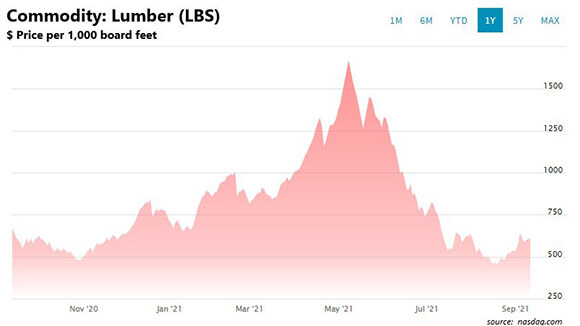

Let’s just look at one building material – lumber – perhaps the single most important building supply. Since the start of the pandemic the price of lumber has fluctuated greatly. The unit price for a thousand board feet of lumber reached a low of $258 in April 2020, and then staggered its way to a record high of $1670 in May 2021. This was an increase of nearly 650%. It fell steadily since then to the mid-$400s in August 2021, but climbed to over $600 in September. Many analysts put the price in the pre-pandemic range of $350 in the months ahead, but it is really anyone’s guess.

Other costs have risen substantially in year-over-year comparisons based on the producer price index (PPI) for new nonresidential building construction. These are the year-over-year percentage rate increases for common building materials:

| Steel mill products | 109% |

| Diesel fuel | 82% |

| Copper and brass mill shapes | 49% |

| Aluminum mill shapes | 33% |

| Plastic construction products | 27% |

| Gypsum products | 22% |

| Truck transportation of freight | 14% |

| Insulation materials | 12% |

| Asphalt felt and coatings | 10% |

Despite increases in material costs, orders are rising. As material costs reach double digits, the costs for new construction are still tempered with moderate single digit increases. Here are the PPI increases for new buildings:

| Warehouse | 6.5% |

| Offices | 5.9% |

| Industrial buildings | 3.9% |

| Schools | 3.3% |

| Healthcare buildings | 3.2% |

These increases impact construction costs, but more importantly, the volatility is changing the construction bidding process. Bid prices are guaranteed for much shorter time periods, requiring quicker decision making. This is expected to continue as long as the price of materials continues to fluctuate unpredictably.

Scheduling also becomes challenging. The bid process may require shorter lead times, while material back-orders extend schedules. Pre-ordering and securing construction materials may become necessary to meet deadlines.

Building supply costs are just one price consideration in the overall cost of construction. Another refrain from construction companies is the shortage of skilled and unskilled labor. As unemployment benefits begin to run out, the labor supply is expected to increase. While this may have some impact, wages are also expected to increase as the labor supply struggles to meet demand.

The pandemic has also impacted the labor market in extraordinary ways. Health and safety rules have limited the number of people allowed on a job site or within a confined work area. Work reductions in government offices have slowed the rate of inspections and permit approvals.

Interest rates have remained the one constant. And while historically low rates will eventually rise, they are expected to do so at a slow rate. However, commercial financing and construction loans are not just based on interest rates. In recent years the architecture of these loans has changed significantly from long-term lending to shorter bridge loans throughout various phases of a project.

As construction booms and resources tighten, smaller projects may get pushed aside by large construction companies. Finding a smaller, yet experienced company may be the right answer for many. Omnia Pacific Construction, a Los Angeles based company specializing in retail and commercial projects, is seeing an uptick in small and mid-level construction. Space conversion, remodeling, and ADA remediation are popular requests.

Another area growing in popularity is space demising. As commercial properties evolve, many larger spaces are looking to demise rooms into smaller, multiple rental units. These projects are perfect for a small construction company, as they require industry experience and expertise but are often too small for the bigger firms.

It is clear that commercial construction is entering a new phase. As labor and supply resources tighten in the months ahead, finding the right construction resources might be essential to complete your project in a timely and cost-effective manner. Tapping into new sources might pleasantly surprise you with the best possible outcome.

Sources:

Construction Material Costs Overall Continue Rise, While Lumber Drops; Floor Daily

https://www.floordaily.net/flooring-news/construction-material-costs-overall-continue-rise-while-lumber-drops

Material Cost Escalation, Delays and COVID-19: Managing Risk in Challenging Times; JD Supra

https://www.jdsupra.com/legalnews/material-cost-escalation-delays-and-3911119

Covid to Impact Construction Claims Until at Least 2023; Pinsent Masons

https://www.pinsentmasons.com/out-law/analysis/covid-impact-construction-claims-2023